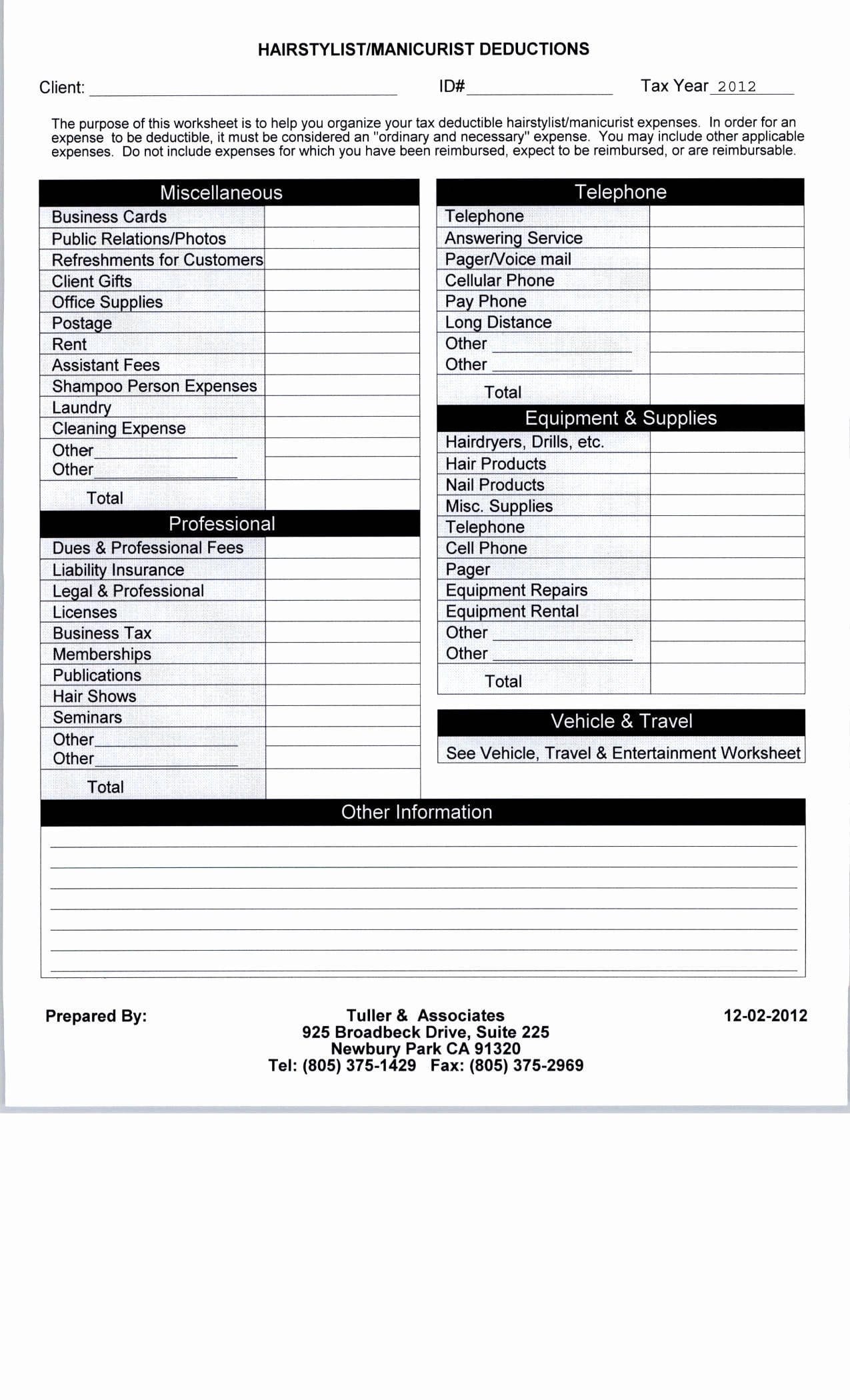

Tax Deduction Worksheet For Donated Clothing. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing's values. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations.

Your vehicle donation will be used to help rehabilitate men and women in our Adult Rehabilitation Centers and will result in a tax deduction in accordance with IRS rules.

The IRS also imposes a rule that clothing and most household items must be in pretty good shape—in "good used condition or better." You can probably forget about taking a tax deduction for that television if you have to bang it to get a picture.

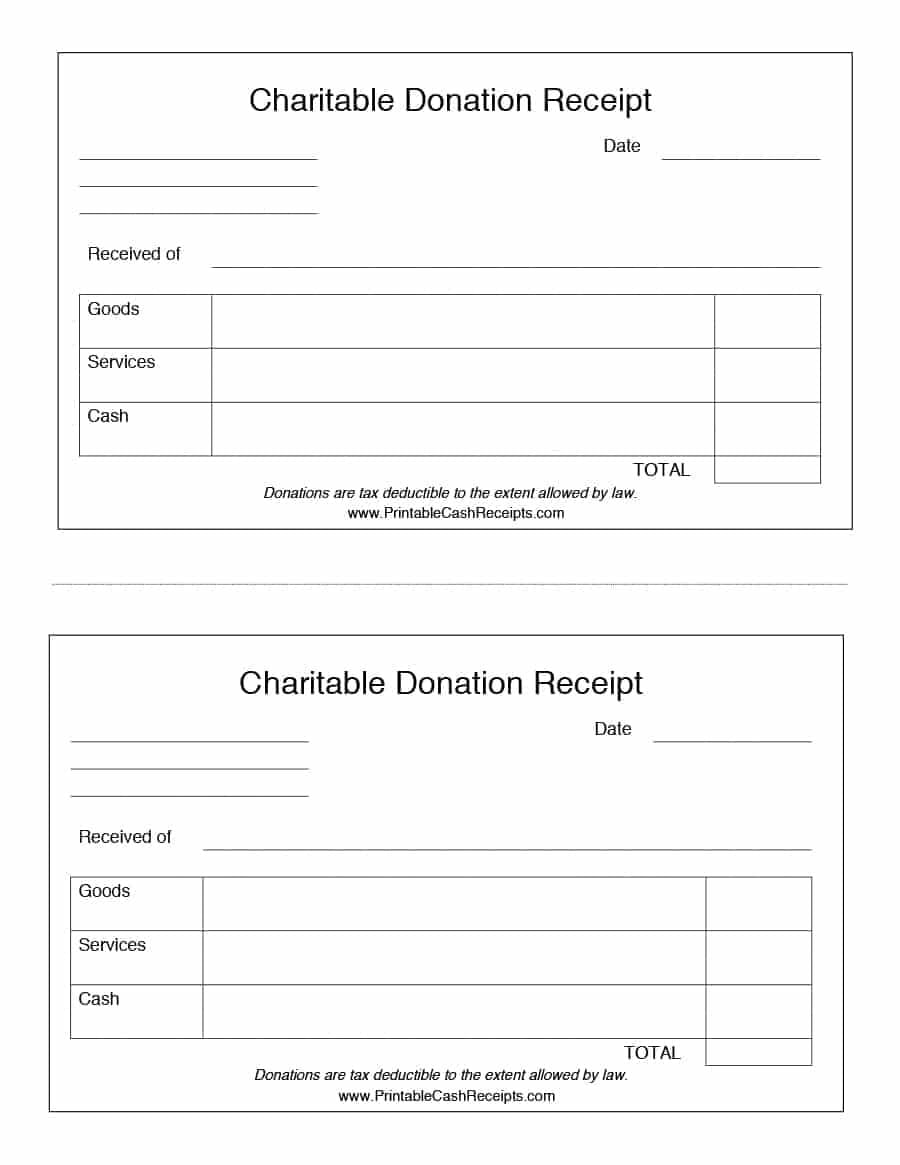

Clothing Donation Tax Deduction Worksheet and Pfp assisting Insolvent Clients the Cpa Journal. This step-by-step guide will help you fill out the donation tax receipt and get things in order for tax season. Describe your Donations on simple worksheets. this is space.