Qualified Dividends And Capital Gains Worksheet Calculator. The usual high-income tax suspects (California, New York, Oregon, Minnesota, New Jersey and Vermont) have high taxes on capital. If you find discrepancies with your credit score or information from your credit report, please NerdWallet's prequalification calculator looks at back-end DTI while also considering other aspects of your credit.

Do not include as qualified dividends any capital gains; payments in lieu of dividends; or dividends paid on deposits with mutual savings banks, cooperative.

Use our Free Tax Tools and Tax Calculator to estimate your taxes or determine eligibility for tax credits or.

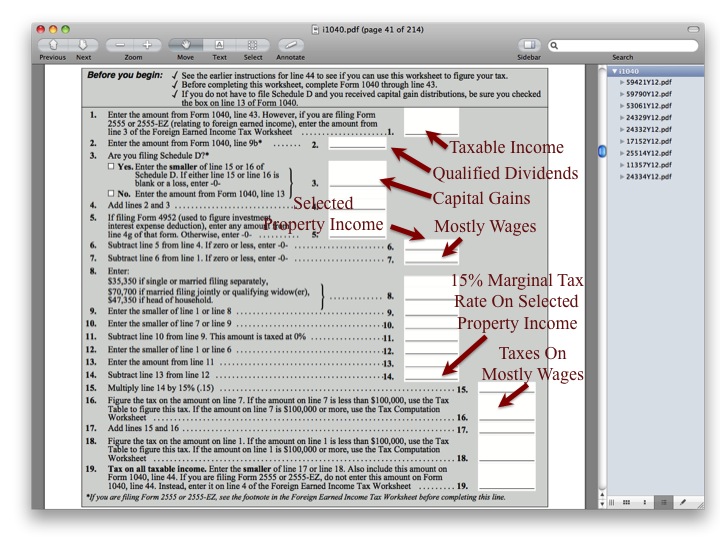

It includes estimates for dividends paid, dividend taxes, capital gains taxes, management fees, and inflation. For this tool to work, it needs to know how much you acquired your property for and how much you sold it for. The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital The summary will include the text Tax computed on Qualified Dividend Capital Gain WS if the tax was calculated on either of these worksheets.