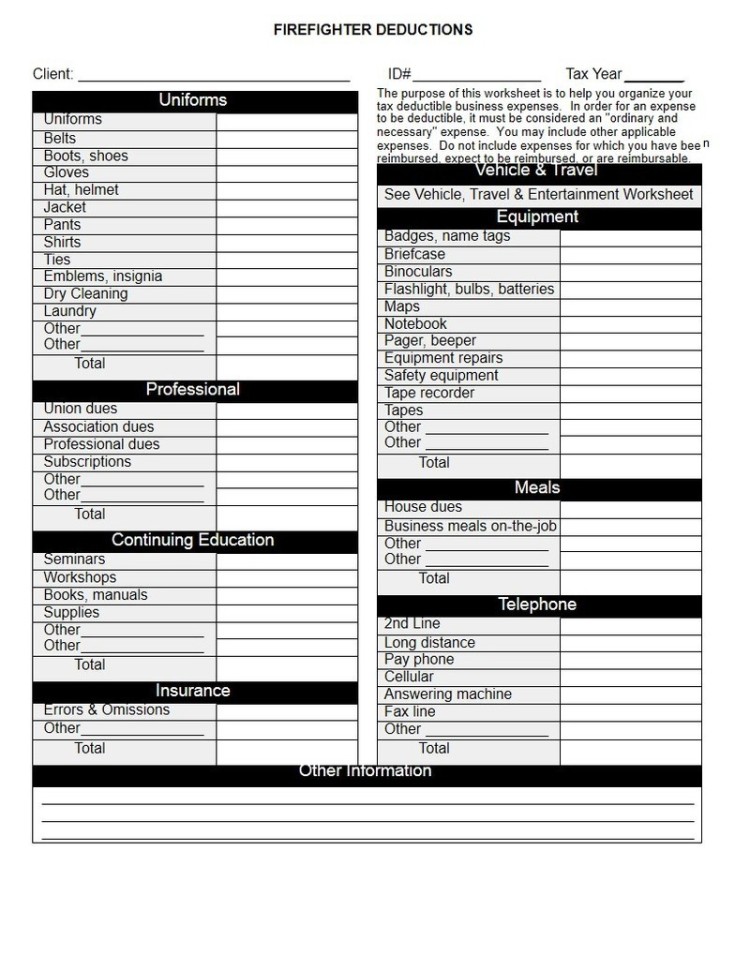

Tax Deduction Worksheet For Firefighters. No warranty or representation, express or implied, is made by Tax Preparation Services, LLC, nor does Tax Preparation Services, LLC accept any liability with respect to the information, data, and resources set. As a firefighter, it is important to know all of the tax deductions that you are allowed to make.

Find out whether they could be the right strategy for you.

How to get the largest tax-break possible by utilizing ALL deductions at your disposal… big or small… Scott will reveal the deductions he knows from his experience as an IRS attorney that.

Ss take a mini test first and then study the grammar points and then. You can save paper and digital receipts separately (paper in a folder and digital on the computer) or combine them into one place. Tax Deductible Missionary Travel Fires, car wrecks and industrial accidents all require firefighters for assistance.